Table of Content

Both offer competitive rates, customer service, easy claims processes, and flexible payment options. The only difference is that one company specializes in auto insurance while the other offers home insurance. Always be honest with insurance companies when the agent asks you questions. Don’t just go with the first offer that you get online or on the phone.

First, make sure to have your home inspected regularly by a qualified professional. This will help you identify any potential problems with your home before they become costly repairs or losses. Additionally, be sure to keep your home up-to-date with the latest safety and security features. This will help protect you and your family in the event of a accident or theft. USAA is a military-themed financial institution with over 14 million members.

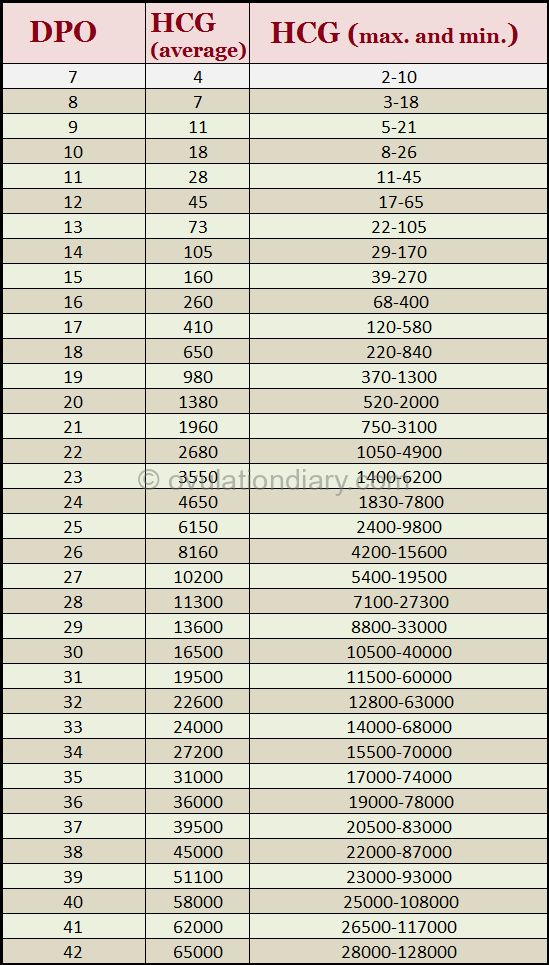

The higher rates range from 0.5 to 0.75 basis points (bps), depending on the bank

Usaa insurance quote unitedhealthcare dual complete usaa renters insurance united healthcare medicare advantage legal and ... Members enjoy access to retirement planning and real estate advice, and they can set up investment accounts or procure mortgages through the company. USAA also offers checking and savings accounts, credit cards, loans, and certificates of deposit available for members. There are a few things that members can do to save on their home insurance.

The limited availability means the company is able to offer benefits and rates on its policies that competitors cannot. The company has better rates than many competitors because of their limited customer base, but these limitations mean not everyone is eligible. So now that you have a good idea of what protections you can expect from USAA, it’s time to discuss a major factor in selecting which policy is right for you — the price. To read why these features are great, read our analysis of USAA home insurance reviews. The most revealing thing about this sample is that to get an additional $100,000 in coverage in some states, you’ll only pay a couple hundred more dollars per year.

USAA Review; What are The Advantages of The USAA Home Insurance Policy?

If you are a former member of the military, enrolled in an eligible program like ROTC, or are the child or spouse of someone in the military, you are eligible for USAA membership. USAA serves its members across all fifty states, however, some states have legislation that prevents certain types of coverage. The easiest way is via the app, where you’ll simply select the insurance icon, and from there, tap claims. You can cancel your policy at any time, and under certain circumstances, you’ll even be refunded the pro-rated amount remaining on your policy. Vehicle storage discounts of up to 60% are available to those you insure a vehicle in storage.

Of course, home insurance rates are specific to your house and its location. The information here should help you make a decision on whether USAA home insurance might be a good choice, but to get an exact quote, you should call an agent to get a quote. As a leading specialist insurer, we provide a superior combination of coverage, service and value to help you protect your most important investments. The claims that must be called in are generally either ones that involve more details or ones that require immediate assistance, such as emergency roadside service calls. Members with routine auto and homeowners claims can also call those in, if they prefer.

USAA Homeowners Insurance Rates

After 5,054 reviews, the company has a 4.6 out of 5 rating, and here are what some of the customers have said. While the company is the cheapest, it certainly isn’t the most expensive, especially for single female drivers, who qualify for some of the best rates out there. Getting estimated quotes for USAA insurance is difficult, as the service is only available to military members. If you’re financing a vehicle through a lender, you’re usually required to have full coverage until the vehicle is paid off—this means comprehensive and collision. In the event of an accident, this insurance helps to pay for repairs to the other person’s car if you’re found at fault.

If you’re a member of the U.S. armed forces, USAA offers comprehensive protection for reasonable prices. What’s the percentage of customers USAA has compared to its competitors? USAA ranks in the top 10 for 48 states—in 24 of those it ranks in the top five. Looking at sheer volume alone, USAA sells the most policies in Texas, Florida, and Virginia. Click in your state below to learn more about home insurance near you. Enter your zip code below to view companies that have cheap insurance rates.

With a USAA homeowners insurance policy, you’ll get $5,000 worth of protection should your identity become compromised. USAA homeowners insurance offers quality protection for service members. USAA also had the highest percentage of auto insurance customers (73%) who said they would buy from the company again.

Many universal life policies pay out dividends and actually grow in value over time. Purchasing a universal life policy for a young child means its value might have doubled or tripled by the end of their life. To start, the company provides free quotes to potential customers, allowing you to see what your rate would be before you make any sort of commitment. Let’s take a look at why the auto insurance policies from USAA are so well-liked. USAA is one of the most well-known insurance providers in the country, and for good reason—it exclusively serves military service members and their families. We strive to help you make confident insurance and legal decisions.

Home office, Caledonia, MI. Each insurer has sole financial responsibility for its own insurance. Use of the term "member" or "membership" refers to membership in USAA Membership Services and does not convey any legal or ownership rights in USAA. The National Guard is a branch of the military and therefore eligible for USAA. You are only eligible if the family member was a parent, and if they are a member of USAA themselves. Widows, widowers, and un-remarried former spouses of USAA members are eligible for membership, as are the children of USAA members. If the rate does increase, the effect will last approximately three years from the date of the ticket.

If someone will drive your car for longer than a few days, they will need insurance of their own. In addition, some states don’t extend coverage to non-primary drivers. USAA offers whole life insurance, which can function as burial insurance.

Our research has shown that rates can vary dramatically among home insurance companies even for the same homeowner. Plus, you might be eligible for discounts with one company and not with another. With the loss of use protection, USAA can cover an increase in living expenses if you need to find another place to live.

The average cost of homeowners insurance when purchased in the USAA network is $1,160. This is an increase from last year when the average cost was $1,050. Keep in mind that this is an average and not all policies will be the same. Some companies may have higher or lower prices based on your location and coverage. The average cost of home insurance for USAA members is about $1,000 per year.

Although not usually the cheapest, USAA home insurance quotes are competitive and generally affordable. The downside is that non-military members and their families are not eligible for USAA insurance products. Overall, USAA members appear satisfied with the insurance coverage they get for the annual premium they pay. USAA home insurance is a solid choice from a company that offers impressive insurance products. If you’d like your own USAA home insurance quote, call one of our licensed agents at [mapi-phone /].

Also, contents like clothing, electronics, and appliances are covered. As a Foremost landlord customer and USAA member, you'll also have discounted access to SmartMove by TransUnion. This convenient service will help you screen tenants and provides many valuable resources for you. Foremost even has programs for customers with credit or loss issues or those who have been declined, cancelled or non-renewed by another company.